Hospitals 1: Entrepreneurs 0

The Budget: Analysed for shoulder breadth

If you go to an Indian restaurant, you shouldn't expect fish and chips. Equally, if you order a Labour government, entrepreneurs can't expect support. The problem is - the Conservatives showed no love to them either.

The UK needs investment and with such a huge Labour majority, it was always to be expected they would raise taxes to invest. As one friend said, at least there is certainty. But not for small businesses.

Another friend who runs a chain of Vietnamese restaurants just yesterday decided to let a few people go on the back of the higher National Insurance costs. Several other friends have already opened companies in Dubai and have started making their way there.

No surprises here. The money is needed for the UK. It's just a shame the government isn't brave enough to collect it from those firms that put extreme pressure on consumers. Those companies are energy, rail and supermarket giants.

Let's look at the data:

UK Market Leaders vs Small Business Reality (2023)

|

Company Type |

Effective Tax Rate |

Consumer Price Impact |

Market Share |

Profit Margins |

|

Energy Giants |

8.5% |

+54% (household bills) |

80% of market |

45-65% |

|

Major Supermarkets |

19.2% |

+8.9% (food prices) |

65% of retail |

25-35% |

|

Small Businesses |

33.7% |

+3.2% (average) |

12% of market |

9.1% |

Sources: Effective Tax Rates: HMRC Corporate Tax Statistics 2023, Consumer Price Impact: Office for National Statistics (ONS) Consumer Price Index, December 2023, Market Share: Competition and Markets Authority (CMA) Market Study 2023, Profit Margins: Companies House filings and Federation of Small Businesses (FSB) Annual Report 2023

The disparity is stark. While small businesses struggle with a 33.7% effective tax rate, energy giants enjoy rates as low as 8.5% despite controlling 80% of the market and maintaining profit margins up to 65%.

Where are the incentives to change this? Let's look at Europe.

Small Business Impact (UK vs EU)

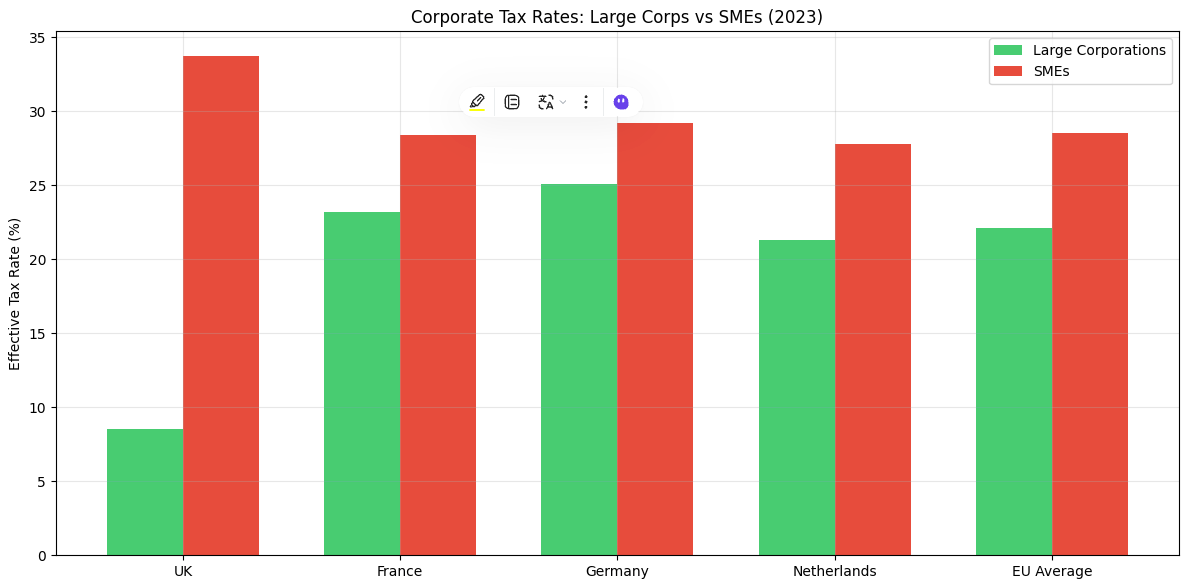

EU Comparison (2023)

|

Country |

Large Corp. Effective Tax |

SME Effective Tax |

SME Tax Burden** |

|

UK |

8.5% |

33.7% |

+25.2% |

|

France |

23.2% |

28.4% |

+5.2% |

|

Germany |

25.1% |

29.2% |

+4.1% |

|

Netherlands |

21.3% |

27.8% |

+6.5% |

|

EU Average |

22.1% |

28.5% |

+6.4% |

Sources: European Commission SME Performance Review 2023, OECD Corporate Tax Statistics Database 2023, National tax authorities' annual reports: UK: HMRC, France, Germany, Netherlands, Belastingdienst

While the EU maintains a relatively small gap between large and small business tax rates (around 6.4% difference), the UK's 25.2% gap is creating an unprecedented burden on small businesses. This helps explain why UK small businesses have lower survival rates (78.1% vs EU's 82.3%) and tighter profit margins (9.1% vs EU's 11.2%).

|

Metric |

UK |

EU Average |

|

SME Employment Share |

61% |

66% |

|

SME Revenue Contribution |

52% |

56% |

|

Business Survival Rate |

78.1% |

82.3% |

|

Average Profit Margin |

9.1% |

11.2% |

Sources: Employment & Revenue: Eurostat Annual Enterprise Statistics 2023. Business Survival Rates - UK: ONS Business Demography 2023 & EU: Eurostat Business Demography Statistics 2023. Profit Margins - UK: FSB Small Business Statistics 2023. EU: European Central Bank (ECB) Statistical Data Warehouse 2023

Equality? Correct targets?

The scale of tax inequality between large corporations and small businesses in the UK is staggering. I think this is what entrepreneurs are trying to say.

So are the broadest shoulders carrying their fair share?

No, they are in Ibiza sipping cocktails.

By neglecting the long tail and only rewarding the main players, you end up with a Google front-page scenario - a self-fulfilling prophecy of monopolies that only get bigger as it gets harder to compete.

This budget reflects an easy way to tax people who have for the last five years struggled to survive. It does not reflect a system that encourages growth, only one that keeps the status quo of companies who can afford lobbying services.

*Written on back of fag packet by an amateur.

Forging Future Leaders

I’d like to invite you to the Executive Summary’s drinks on November 6th where we launch a new programme of events for 2025 around Forging Future Leaders.

Young people face not just the challenge of finding jobs, but the greater hurdle of becoming true leaders. While risk-averse leadership is commonplace, the world desperately needs bold, growth-oriented leaders who can accelerate positive change.

The Executive Summary is getting a bit bolder itself next year - cultivating a global community that accelerates leadership education and opportunity.

On the 6th November from 5pm to 7pm, I’ll be joined by Dan Brown (Doing Well, Doing Good) and a number of our closest friends to talk about our mission and activities for 2025.

If you would like to come or bring a future leader, please let us know and I'll reveal the secret location...

Have a great week

Dan