The No-Grow-Zone Budget

The how-to-open-an-online-shop edition

Entrepreneurs and CEOs are wincing at the critical hacks the bludgeoner budget slasher took to the economy yesterday. Rather than show any adherence to a growth narrative on establishing trade and bolstering inward investment , Rachel Reeves kicked the can down the road and instead took more internal measures to balance the books.

The United Kingdom’s absence of a robust global trade and growth strategy has left its economy vulnerable.

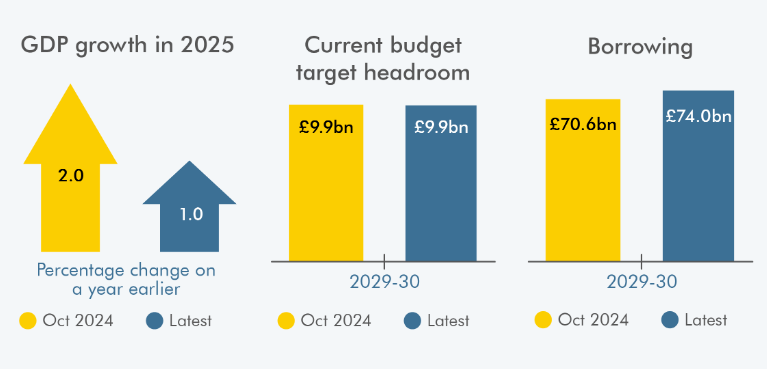

Yet Reeves is pushing for deeper cuts. The Labour Chancellor yesterday announced £4.8 billion in welfare reductions and £3.5 billion in savings through civil service headcount cuts. These moves are intended to turn a projected £4.1 billion deficit into a £9.9 billion surplus by 2029.

But this is not growth strategy rather an internal redistribution. Business investment is lagging. Productivity is flat. Exports are weak. And government continues to ignore the single biggest unlock available: trade.

The entrepreneurs smell blood and are starting to leave.

Globally, things are getting harder

Since Brexit, UK exports to the EU have fallen by 17 percent. The government has made no real effort to reverse that trend. The British Chambers of Commerce has warned that unless the UK becomes far more ambitious in rebuilding its relationship with the EU, the UK risks long-term erosion of our goods market.

At the same time, the UK’s signature onto the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) still has no trade strategy wrapped around it. This is a platform, not a solution. Membership alone means nothing if government fails to support businesses into those markets.

The UK is scrambling to avoid US auto tariffs as Trump-era protectionism kicks back in - for how long, we shall see. Knee-jerk, reactive panic does not suit the stiff-upper lip image the UK is known for. Steady and confident does.

So where should the UK focus?

The UK has a clear opportunity to lead in high-value exports - if it gets serious about trade. In advanced engineering and manufacturing, British firms are already world-class, with the sector contributing £224 billion to the economy in 2023.

The country’s strength in clean energy and nuclear, including offshore wind and small modular reactors, positions it to lead the energy transition.

London remains a global centre for financial and professional services, while creative industries, from film and music to design and gaming, offer soft-power exports with high global demand. In life sciences and cybersecurity, the UK has the R&D strength and sovereign trust to lead.

Defence technology is in hot demand globally as geopolitical tensions rise. British firms are seeing strong growth in aerospace, naval tech and AI-led surveillance. With NATO and Five Eyes access, trust is a competitive edge.

This is the moment for a trade strategy that enables - not inhibits - sectors ready to scale globally.

What CEOs should do now:

- Rebuild your narrative around global growth - you might need it if you need to change location.

- Be vocal. Shape media coverage on growth and opportunity. Cost-cutting is a short-term measure.

- Force your trade agenda. Show the world your export strategy.

- Exploit the CPTPP window

- Assume a two-speed economy is here - * Those who go global will survive. Those who stay domestic may struggle.

- Government isn’t going to drive growth - business must.

Build trade. Build narratives. Build opportunity.

Have a good day

Dan

PS sorry it was late today. My youngest son wanted to have breakfast with me.